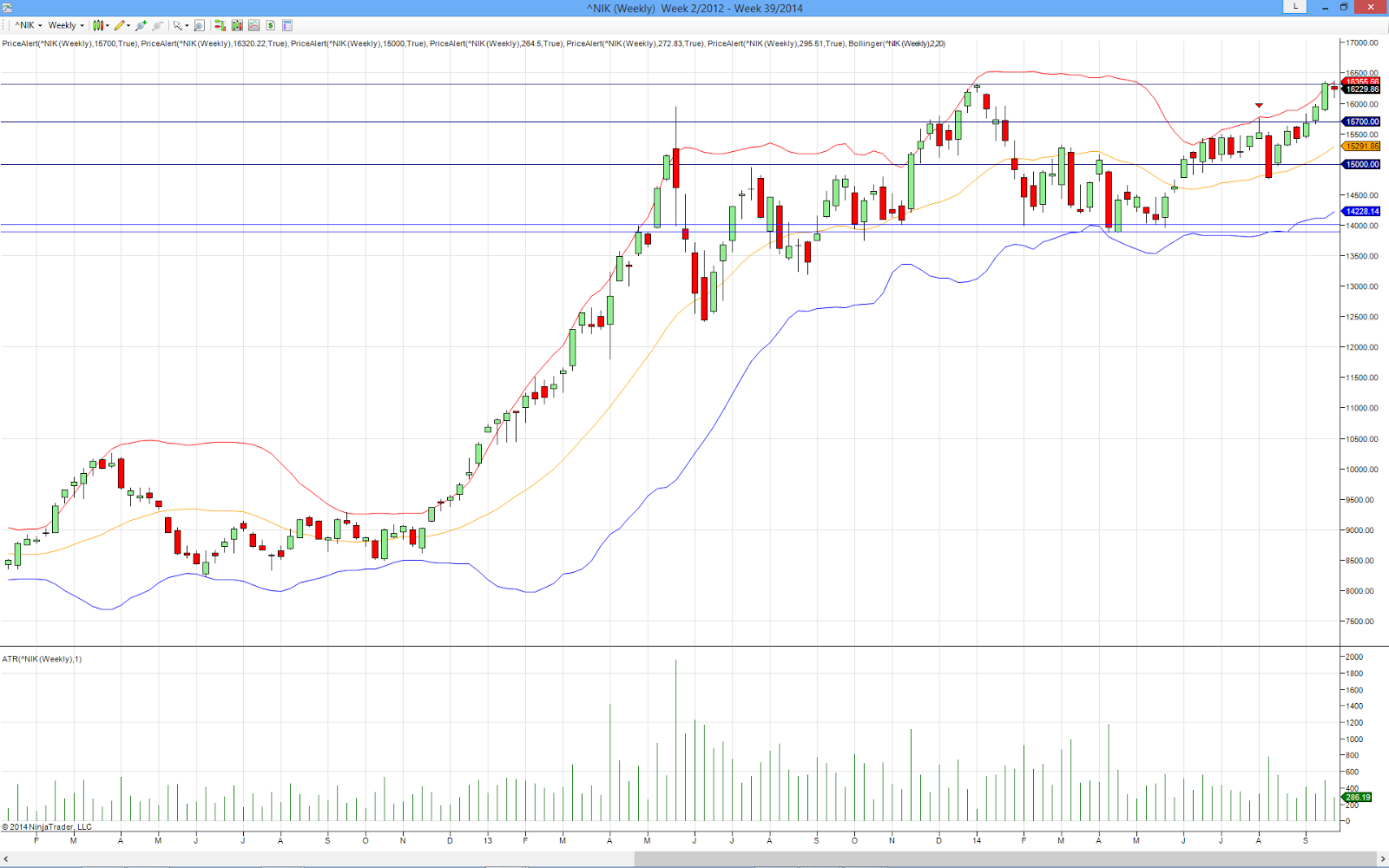

At 8:10am, N225 was at 16,178.32, Delta was at 0.2394. Bid-Ask spread was 43-37, 6pt spread.

The minimum fluctuation is 1pt for 50pt or less and 5pt for over 50pt up to 1,000pt.

At 8:39am, after sending kids to school, N225 went up 20pts to 16,198.84,

Delta was at 0.2512, Bid-Ask spread was 46-40. Base on last close price 80-34, the spread was 46.

Loss is 228% of credit (46 minus credit of 14 divide by 14).

Base on the criteria (Delta > 0.25 or/and Loss > 200% of creidt) in my Exit Strategy, I should close this call spread immediately, for Stop Loss or for Adjustment.

I didn't! I spend the next hour trying to determine what contract to roll out & up. Well, I have long determined in my weekly review that I will not just roll up to current month as the DTE is too short. I will roll out to next month, November contract. However, I have not determined what Strike price to roll up too.

Worst! Besides looking at what Call Spread to roll out to, I was also looking at what Put Spread to form Iron Condor.

By 9.43am, N225 went up more than 80pts to 16,282.92. At this point, N225 is up 216pts!

Delta was at 0.3012, Bid-Ask spead was 59-53. Base on last close price 105-47, the spread was 58.

Loss is 314% of credit.While I managed to close at 55 as written in this

post, it was lucky as there was a dip/retrace when I tried to cover in separate legs. Not a repeatable process.

At 12.15pm, N225 went up to 16,361.86. The spread had also gone up and widen to 75-65, 10pts spread because the 16,750 Call price went up above 50pts.

Conclusion1. The first cut loss is always the best cut loss

If I had cut loss at 8.39am, when both criteria hit, I could sell the spread at 46 (suffered 6pts spread). The loss will be 32pts (JPY 32,000), 228% of credit.

2. Focus on closing the loss position

I should spend time closing the loss position instead of rolling/adjusting. Cut loss should execute fast while new position should always take time to find best opportunity. Juggling between cutting loss and opening new position simply didn't work. Time is not on our side.

3. Should I cut loss on the loss leg first?In the Call Spead, it is the Short leg that is suffering the loss. If I have cut the loss leg first at 80 (buy at Ask price), I sell the Long leg later at 60. The spread will end up at 20. The loss will be 42% of credit (20 minus credit of 14 divide by 14).

This idea is yet to be explored before it is put in Trading Plan.