K200 closed at 258.33 on Friday, 26-Sep-2014, lost 3.98 (1.52%) over the last 5 trading days.

Looking at the bigger picture on daily chart, K220 continue going down while trying to go up. And it established a lower high and a lower low. It is now on downtrend.

Looking at the Weekly chart, K200 drop below the trend line and ended lower. Unless we get a bullish bar and ended above the trend line, we might have weekly downtrend soon.

Att Monthly chart, K200 dip briefly below the uptrend line. This is again bearish. With another few days to go. Let's see if it end below or above the uptrend line.

November Position : Iron Condor 242.5/245/280/282.5

I have closed the Call Spread 280/282.5 as it reached my target profit exit criteria. Will update in separate post.

November Position, with only the Put Spread 242.5/245, is currently at a paper lost of about 0.03 points (KRW 15,000, before commission). K200 is about 11 points away from the Short Put. Delta is at 0.1309 for Short Put. DTE is 47 days. This position looks ok. Just need to keep a close watch on the Delta.

Trading Calendar

Friday Oct-3: KSE will be closed for trading

This blog is to pen down my journey of trading Options. I focus primary on the Options in Asia Pacific, especially KOSPI 200 Options in Korea Stock Exchange (KRE). The main strategy is Selling Options, in particular Credit Spread and Iron Condor.

Saturday, September 27, 2014

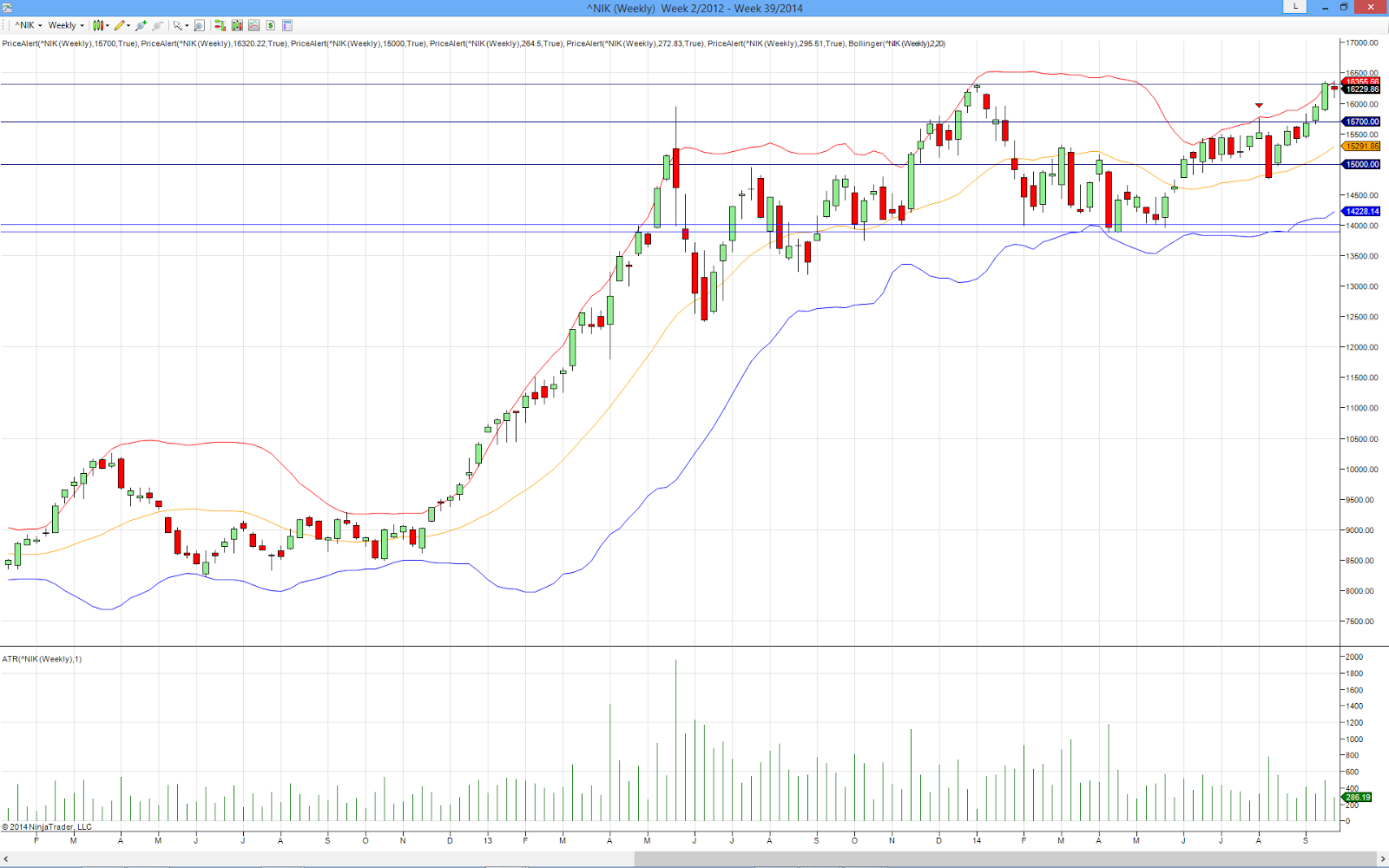

Weekly Market Reivew N225

N225 closed at 16,229.86 on Friday, 26-Sep-2014, lost 91.31 (0.56%) over the last 4 trading days. NKVI lost 0.03 (0.18%) ending the week at 16.66.

N225 managed to get back below the top Bollinger Band, but not much. And the band has widen. N225 has been grinding up since August 8 low. This is no good for selling Iron Condor or even just Call/Put spread. The low volatility didn't provide good premium. In fact, I couldn't find a good premium to sell Put spread to form Iron Condor. And, the Call spread is being challenged every time N225 edges up. Should I consider buying option instead of just selling option?

Both the weekly and monthly chart continue to look bullish. Not much has changed.

N225 managed to get back below the top Bollinger Band, but not much. And the band has widen. N225 has been grinding up since August 8 low. This is no good for selling Iron Condor or even just Call/Put spread. The low volatility didn't provide good premium. In fact, I couldn't find a good premium to sell Put spread to form Iron Condor. And, the Call spread is being challenged every time N225 edges up. Should I consider buying option instead of just selling option?

Both the weekly and monthly chart continue to look bullish. Not much has changed.

November Position : Call Spread 17250/17500, 17375/17625

November 17250/17500 position is currently at a paper loss of about 8 points (JPY 8,000, before commission). N225 is about 1020 points away from the Short Call. Delta is at 0.1252. DTE is 47 days. This position looks ok. Just need to keep a watch on the Delta movement.

November 17250/17500 position is currently at a paper loss of about 8 points (JPY 8,000, before commission). N225 is about 1020 points away from the Short Call. Delta is at 0.1252. DTE is 47 days. This position looks ok. Just need to keep a watch on the Delta movement.

November 17375/17625 position is currently at a paper gained of about 1 points (JPY 1,000, before commission). N225 is about 1145 points away from the Short Call. Delta is at 0.1030. DTE is 47 days. This position looks ok. No action needed.

Sunday, September 21, 2014

Weekly Market Reivew K200

K200 closed at 262.31 on Friday, 19-Sep-2014, lost 0.92 (0.35%) over the last 5 trading days.

Looking at the bigger picture on daily chart, K220 stop going down and try going up. However, the strength seems weak. It only climb 0.92 for 5 trading days. If K220 didn't continue the push to go higher in the coming week(s), it will establish another lower high. This will be very bearish.

Looking at the Weekly chart, K200 dip briefly below the trend line and move up. However, as in daily chart, the move up didn't seem strong. The next week is important for it to show its strength or weakness.

Not much change at Monthly chart, K200 is heading lower. Will it be bounce off the uptrend line like the past few months?

October Position: October 2014 K200 Iron Condor

October Position is closed with the Close October 2014 K200 Put Spread of Iron Condor.

November Position : Iron Condor 242.5/245/280/282.5

November Position is currently at a paper gain of about 0.14 points (KRW 70,000, before commission). K200 is about 16 points away from the Short Call; 17 points away from the Short Put. Delta is at 0.0771 for Short Call; 0.0761 for Short Put(finally, this week IB is correct). DTE is 54 days. This position looks good. No action required.

Looking at the bigger picture on daily chart, K220 stop going down and try going up. However, the strength seems weak. It only climb 0.92 for 5 trading days. If K220 didn't continue the push to go higher in the coming week(s), it will establish another lower high. This will be very bearish.

Looking at the Weekly chart, K200 dip briefly below the trend line and move up. However, as in daily chart, the move up didn't seem strong. The next week is important for it to show its strength or weakness.

Not much change at Monthly chart, K200 is heading lower. Will it be bounce off the uptrend line like the past few months?

October Position: October 2014 K200 Iron Condor

October Position is closed with the Close October 2014 K200 Put Spread of Iron Condor.

November Position : Iron Condor 242.5/245/280/282.5

November Position is currently at a paper gain of about 0.14 points (KRW 70,000, before commission). K200 is about 16 points away from the Short Call; 17 points away from the Short Put. Delta is at 0.0771 for Short Call; 0.0761 for Short Put(finally, this week IB is correct). DTE is 54 days. This position looks good. No action required.

Weekly Market Reivew N225

N225 closed at 16,321.17 on Friday, 19-Sep-2014, gained 372.88 (2.34%) over the last 4 trading days. NKVI gained 0.34 (1.93%) ending the week at 16.69.

NKVI finally dropped with the rise of N225. This is usual.

Last week, I mentioned that N225 may bash through 16,000 and challenge the previous high at 16,320.22. Not only, it closed above it. It reached a high of 16,364.08, highest since 2008. While the Friday bar is very bullish, it is also way above Bollinger Band. Will it take a breather to retrace before going up?

Both the weekly and monthly chart continue to look bullish. The weekly chart, like the daily chart, seems a bit over extended on the Bollinger Band. Will we get a retracement?

November Position : Call Spread 17250/17500, 17375/17625

November 17250/17500 position is currently at a paper loss of about 11 points (JPY 11,000, before commission). N225 is about 928 points away from the Short Call. Delta is at 0.1534. DTE is 54 days. This position does not looks good. Need to monitor closely on the Delta movement.

November 17375/17625 position is currently at a paper loss of about 3 points (JPY 3,000, before commission). N225 is about 1053 points away from the Short Call. Delta is at 0.1261. DTE is 54 days. This position looks ok. No action needed.

Trading Calendar

Monday Sep-23: OSE will be closed for trading

NKVI finally dropped with the rise of N225. This is usual.

Last week, I mentioned that N225 may bash through 16,000 and challenge the previous high at 16,320.22. Not only, it closed above it. It reached a high of 16,364.08, highest since 2008. While the Friday bar is very bullish, it is also way above Bollinger Band. Will it take a breather to retrace before going up?

Both the weekly and monthly chart continue to look bullish. The weekly chart, like the daily chart, seems a bit over extended on the Bollinger Band. Will we get a retracement?

November Position : Call Spread 17250/17500, 17375/17625

November 17250/17500 position is currently at a paper loss of about 11 points (JPY 11,000, before commission). N225 is about 928 points away from the Short Call. Delta is at 0.1534. DTE is 54 days. This position does not looks good. Need to monitor closely on the Delta movement.

November 17375/17625 position is currently at a paper loss of about 3 points (JPY 3,000, before commission). N225 is about 1053 points away from the Short Call. Delta is at 0.1261. DTE is 54 days. This position looks ok. No action needed.

Trading Calendar

Monday Sep-23: OSE will be closed for trading

Add November 2014 N225 Call Spread

Sep-19, I sold a N225 Call Spread 17375/17625 when N225 was at 16274.20.

Details:

Buy N225 October 17625 Call at 35 (Delta: 0.0792)

Sell N225 October 17375 Call at 50 (Delta: 0.1187)

N225 at 16274.20 (~1100 points upside)

Credit received : 20 (JPY 20,000)

Max risk: 230 (JPY 230,000)

Margin: JPY 100,000

ROM: 20%

Days to expiration (DTE): 55

Below is the chart as at close of Sep-19:

This the P&L Chart as at close of Sep-19:

Details:

Buy N225 October 17625 Call at 35 (Delta: 0.0792)

Sell N225 October 17375 Call at 50 (Delta: 0.1187)

N225 at 16274.20 (~1100 points upside)

Credit received : 20 (JPY 20,000)

Max risk: 230 (JPY 230,000)

Margin: JPY 100,000

ROM: 20%

Days to expiration (DTE): 55

Below is the chart as at close of Sep-19:

This the P&L Chart as at close of Sep-19:

Saturday, September 20, 2014

Mistakes made in Cutting Loss

At 8:10am, N225 was at 16,178.32, Delta was at 0.2394. Bid-Ask spread was 43-37, 6pt spread.

At 8:39am, after sending kids to school, N225 went up 20pts to 16,198.84, Delta was at 0.2512, Bid-Ask spread was 46-40. Base on last close price 80-34, the spread was 46. Loss is 228% of credit (46 minus credit of 14 divide by 14).

Base on the criteria (Delta > 0.25 or/and Loss > 200% of creidt) in my Exit Strategy, I should close this call spread immediately, for Stop Loss or for Adjustment.

I didn't! I spend the next hour trying to determine what contract to roll out & up. Well, I have long determined in my weekly review that I will not just roll up to current month as the DTE is too short. I will roll out to next month, November contract. However, I have not determined what Strike price to roll up too.

Worst! Besides looking at what Call Spread to roll out to, I was also looking at what Put Spread to form Iron Condor.

By 9.43am, N225 went up more than 80pts to 16,282.92. At this point, N225 is up 216pts! Delta was at 0.3012, Bid-Ask spead was 59-53. Base on last close price 105-47, the spread was 58. Loss is 314% of credit.

While I managed to close at 55 as written in this post, it was lucky as there was a dip/retrace when I tried to cover in separate legs. Not a repeatable process.

At 12.15pm, N225 went up to 16,361.86. The spread had also gone up and widen to 75-65, 10pts spread because the 16,750 Call price went up above 50pts.

Conclusion

1. The first cut loss is always the best cut loss

If I had cut loss at 8.39am, when both criteria hit, I could sell the spread at 46 (suffered 6pts spread). The loss will be 32pts (JPY 32,000), 228% of credit.

2. Focus on closing the loss position

I should spend time closing the loss position instead of rolling/adjusting. Cut loss should execute fast while new position should always take time to find best opportunity. Juggling between cutting loss and opening new position simply didn't work. Time is not on our side.

3. Should I cut loss on the loss leg first?

In the Call Spead, it is the Short leg that is suffering the loss. If I have cut the loss leg first at 80 (buy at Ask price), I sell the Long leg later at 60. The spread will end up at 20. The loss will be 42% of credit (20 minus credit of 14 divide by 14).

This idea is yet to be explored before it is put in Trading Plan.

The minimum fluctuation is 1pt for 50pt or less and 5pt for over 50pt up to 1,000pt.

At 8:39am, after sending kids to school, N225 went up 20pts to 16,198.84, Delta was at 0.2512, Bid-Ask spread was 46-40. Base on last close price 80-34, the spread was 46. Loss is 228% of credit (46 minus credit of 14 divide by 14).

Base on the criteria (Delta > 0.25 or/and Loss > 200% of creidt) in my Exit Strategy, I should close this call spread immediately, for Stop Loss or for Adjustment.

I didn't! I spend the next hour trying to determine what contract to roll out & up. Well, I have long determined in my weekly review that I will not just roll up to current month as the DTE is too short. I will roll out to next month, November contract. However, I have not determined what Strike price to roll up too.

Worst! Besides looking at what Call Spread to roll out to, I was also looking at what Put Spread to form Iron Condor.

By 9.43am, N225 went up more than 80pts to 16,282.92. At this point, N225 is up 216pts! Delta was at 0.3012, Bid-Ask spead was 59-53. Base on last close price 105-47, the spread was 58. Loss is 314% of credit.

While I managed to close at 55 as written in this post, it was lucky as there was a dip/retrace when I tried to cover in separate legs. Not a repeatable process.

At 12.15pm, N225 went up to 16,361.86. The spread had also gone up and widen to 75-65, 10pts spread because the 16,750 Call price went up above 50pts.

Conclusion

1. The first cut loss is always the best cut loss

If I had cut loss at 8.39am, when both criteria hit, I could sell the spread at 46 (suffered 6pts spread). The loss will be 32pts (JPY 32,000), 228% of credit.

2. Focus on closing the loss position

I should spend time closing the loss position instead of rolling/adjusting. Cut loss should execute fast while new position should always take time to find best opportunity. Juggling between cutting loss and opening new position simply didn't work. Time is not on our side.

3. Should I cut loss on the loss leg first?

In the Call Spead, it is the Short leg that is suffering the loss. If I have cut the loss leg first at 80 (buy at Ask price), I sell the Long leg later at 60. The spread will end up at 20. The loss will be 42% of credit (20 minus credit of 14 divide by 14).

This idea is yet to be explored before it is put in Trading Plan.

Thursday, September 18, 2014

Close October 2014 N225 Call Spread of Iron Condor

On Sep-19, I closed the N225 October 2014 Call Spread of Iron Condor 13250/13500/16500/16750.

Details:

Sell N225 October 16750Call at 50

Buy N225 October 16500 Call at 105

Sell N225 October 16750Call at 50

Buy N225 October 16500 Call at 105

Note: All calculation before commission

Credit received : 14 (JPY 14,000)

Credit paid : 55 (JPY 55,000)

Loss : 41 (JPY 41,000), 293% of Credit

Margin : ~JPY 100,000 for full Iron Condor

Loss On Margin (LOM) : 41% or 82% for full Iron Condor or half Iron Condor respectively

Days on Trade : 39

Credit received : 14 (JPY 14,000)

Credit paid : 55 (JPY 55,000)

Loss : 41 (JPY 41,000), 293% of Credit

Margin : ~JPY 100,000 for full Iron Condor

Loss On Margin (LOM) : 41% or 82% for full Iron Condor or half Iron Condor respectively

Days on Trade : 39

Close October 2014 K200 Put Spread of Iron Condor

Sep-19, I closed the K200 October 2014 Put Spread of Iron Condor 247.5/250/277.5/280.

Details:

Buy K200 October 250 Put at 0.17

Sell K200 October 247.5 Put at 0.13

Note: All calculation before commission

Credit received : 0.20 (KRW 100,000)

Credit paid : 0.04 (KRW 20,000)

Profit : 0.16 (KRW 80,000), 80% of Credit

Margin : ~KRW 1,000,000 for full Iron Condor

Return On Margin (ROM) : 8% or 16% for full Iron Condor or half Iron Condor respectively

Days on Trade : 30

Details:

Buy K200 October 250 Put at 0.17

Sell K200 October 247.5 Put at 0.13

Note: All calculation before commission

Credit received : 0.20 (KRW 100,000)

Credit paid : 0.04 (KRW 20,000)

Profit : 0.16 (KRW 80,000), 80% of Credit

Margin : ~KRW 1,000,000 for full Iron Condor

Return On Margin (ROM) : 8% or 16% for full Iron Condor or half Iron Condor respectively

Days on Trade : 30

Sunday, September 14, 2014

Weekly Market Reivew K200

K200 closed at 261.39 on Friday, 12-Sep-2014, lost 0.70 (0.27%) over the last 2 trading days.

Looking at the bigger picture on daily chart, K220 continues to get lower. It established another lower low this week, even with just 2 trading days. K220 has dropped quite a far bit since July high 272.83. It is currently at Fibonacci Retracement of 76.40%. How far more will it go before it takes a breather? Will it go 100%? Let's see.

Looking at the Weekly chart, K200 seems to form a pin bar touching the uptrend line. However, this week had only 2 days. The next week bar will be more reliable for us to determine if it is bouncing off the uptrend line like past weeks.

Not much change at Monthly chart, K200 is heading lower. Will it be bounce off the uptrend line like the past few months?

October Position: Put Spread 247.5/250

October Position has a paper gain of about 0.12 points (KRW 60,000, before commission). K200 is about 11 points away from the Short Put. Delta is at 0.0880. DTE is 25 days. This position looks good. No action required.

November Position : Iron Condor 242.5/245/280/282.5

November Position is currently at a paper gain of about 0.12 points (KRW 60,000, before commission). K200 is about 18 points away from the Short Call; 16 points away from the Short Put. Delta is at 0.3724 for Short Call; 0.3070 for Short Put(definitely wrong, typical problem for IB) as per IB chart. DTE is 68 days. This position looks good. No action required.

Another obvious mistake by IB is the theoretical and hypothetical P&L chart as at close of next week 19-Sep. It is impossible for the Iron Condor to have profit higher than the credit received.

Looking at the bigger picture on daily chart, K220 continues to get lower. It established another lower low this week, even with just 2 trading days. K220 has dropped quite a far bit since July high 272.83. It is currently at Fibonacci Retracement of 76.40%. How far more will it go before it takes a breather? Will it go 100%? Let's see.

Looking at the Weekly chart, K200 seems to form a pin bar touching the uptrend line. However, this week had only 2 days. The next week bar will be more reliable for us to determine if it is bouncing off the uptrend line like past weeks.

Not much change at Monthly chart, K200 is heading lower. Will it be bounce off the uptrend line like the past few months?

October Position: Put Spread 247.5/250

October Position has a paper gain of about 0.12 points (KRW 60,000, before commission). K200 is about 11 points away from the Short Put. Delta is at 0.0880. DTE is 25 days. This position looks good. No action required.

November Position : Iron Condor 242.5/245/280/282.5

November Position is currently at a paper gain of about 0.12 points (KRW 60,000, before commission). K200 is about 18 points away from the Short Call; 16 points away from the Short Put. Delta is at 0.3724 for Short Call; 0.3070 for Short Put(definitely wrong, typical problem for IB) as per IB chart. DTE is 68 days. This position looks good. No action required.

Another obvious mistake by IB is the theoretical and hypothetical P&L chart as at close of next week 19-Sep. It is impossible for the Iron Condor to have profit higher than the credit received.

Weekly Market Reivew N225

N225 closed at 15,948.29 on Friday, 12-Sep-2014, gained 279.61 (1.78%) over the last 5 trading days. NKVI gained 0.34 (1.93%) ending the week at 18.

NKVI continue to climb with N225, despite slower, like last week. This is unusual. Such anomaly should not persist too long. Else, something unusual may happen. Let's watch it carefully.

Last week, I mentioned that the range could be expanded to 15,000-16,000 range. It was almost there. It reached a high of 15984.90 on Friday. Will 16,000 be a resistance? Or will N225 bash through it and challenge the previous high at 16,320.22? Let the market tell us.

Both the weekly and monthly chart look bullish. It seems that they are going towards the previous high of 16,320.22.

October Position: Call Spread 16500/16750

October Position has a paper loss of about 13 points (JPY 13,000, before commission). N225 is about 540 points away from the Short Call. Delta is at 0.1626. DTE (Days To Expiration) is 26 days.

This position is bad. The loss is almost 100% (credit was 14 points). One of my adjustment criteria is when loss is 200%. I have to watch closely this.

Delta is also bad at 0.1626. The other adjustment criteria is when it is over 25 to 30. This is the second item I need to watch closely in the coming week.

If either one of the above criteria met, I will make the adjustment. With DTE only <26 days, I will not roll up. Instead, I will roll out and up to November contract.

The at the money call 16,000 is selling at 185 (Ask price). The sellers do not believe N225 will be above 16,185 at October expiration? The at the money call 15875 is selling at 240 (Ask price). The sellers do not believe N225 will be above 16,115 at October expiration? So, is my Short Call 16,500 safe?

November Position : Call Spread 17250/17500

November Position is currently at a paper loss of about 1 points (JPY 1,000, before commission). N225 is about 1300 points away from the Short Call. Delta is at 0.0957. DTE is 61 days. This position looks good. No action required. Waiting for opportunity to add the Put Spread leg to form an Iron Condor.

Trading Calendar

Monday Sep-15: OSE will be closed for trading

NKVI continue to climb with N225, despite slower, like last week. This is unusual. Such anomaly should not persist too long. Else, something unusual may happen. Let's watch it carefully.

Last week, I mentioned that the range could be expanded to 15,000-16,000 range. It was almost there. It reached a high of 15984.90 on Friday. Will 16,000 be a resistance? Or will N225 bash through it and challenge the previous high at 16,320.22? Let the market tell us.

Both the weekly and monthly chart look bullish. It seems that they are going towards the previous high of 16,320.22.

October Position: Call Spread 16500/16750

October Position has a paper loss of about 13 points (JPY 13,000, before commission). N225 is about 540 points away from the Short Call. Delta is at 0.1626. DTE (Days To Expiration) is 26 days.

This position is bad. The loss is almost 100% (credit was 14 points). One of my adjustment criteria is when loss is 200%. I have to watch closely this.

Delta is also bad at 0.1626. The other adjustment criteria is when it is over 25 to 30. This is the second item I need to watch closely in the coming week.

If either one of the above criteria met, I will make the adjustment. With DTE only <26 days, I will not roll up. Instead, I will roll out and up to November contract.

The at the money call 16,000 is selling at 185 (Ask price). The sellers do not believe N225 will be above 16,185 at October expiration? The at the money call 15875 is selling at 240 (Ask price). The sellers do not believe N225 will be above 16,115 at October expiration? So, is my Short Call 16,500 safe?

November Position : Call Spread 17250/17500

November Position is currently at a paper loss of about 1 points (JPY 1,000, before commission). N225 is about 1300 points away from the Short Call. Delta is at 0.0957. DTE is 61 days. This position looks good. No action required. Waiting for opportunity to add the Put Spread leg to form an Iron Condor.

Trading Calendar

Monday Sep-15: OSE will be closed for trading

Saturday, September 6, 2014

Weekly Market Reivew K200

K200 closed at 262.09 on Friday, 5-Sep-2014, lost 3.32 (1.25%) over the last 5 trading days.

Looking at the bigger picture on daily chart, K220 get lower low this week with the lower high last week. I will wait for a another lower high to confirm change of trend.

Looking at the Weekly/Monthly chart, K200 is heading lower. Will it be bounce off the uptrend line like the past few weeks/months?

October Position: Put Spread 247.5/250

October Position has a paper gain of about 0.07 points (KRW 35,000, before commission). K200 is about 12 points away from the Short Put. Delta is at 0.0723. DTE is 32 days. This position looks good. No action required.

November Position : Iron Condor 242.5/245/280/282.5

November Position is currently at a paper gain of about 0.02 points (KRW 10,000, before commission). K200 is about 18 points away from the Short Call; 17 points away from the Short Put. Delta is at 0.3673 for Short Call; 0.2426 for Short Put(definitely wrong, typical problem for IB) as per IB chart. My screen capture as on Friday close is 0.0947 for Short Call & 0.1028 for Short Put. DTE is 68 days. This position looks good. No action required.

Another obvious mistake by IB is the theoretical and hypotehtical P&L chart as at close of next week 12-Sep. It is impossible for the Iron Condor to have profit higher than the credit received.

Trading Calendar

Monday Sep-8: KSE will be closed for trading

Tuesday Sep-9: KSE will be closed for trading

Wednesday Sep 10: KSE will be closed for trading

Looking at the bigger picture on daily chart, K220 get lower low this week with the lower high last week. I will wait for a another lower high to confirm change of trend.

Looking at the Weekly/Monthly chart, K200 is heading lower. Will it be bounce off the uptrend line like the past few weeks/months?

October Position: Put Spread 247.5/250

October Position has a paper gain of about 0.07 points (KRW 35,000, before commission). K200 is about 12 points away from the Short Put. Delta is at 0.0723. DTE is 32 days. This position looks good. No action required.

November Position : Iron Condor 242.5/245/280/282.5

November Position is currently at a paper gain of about 0.02 points (KRW 10,000, before commission). K200 is about 18 points away from the Short Call; 17 points away from the Short Put. Delta is at 0.3673 for Short Call; 0.2426 for Short Put(definitely wrong, typical problem for IB) as per IB chart. My screen capture as on Friday close is 0.0947 for Short Call & 0.1028 for Short Put. DTE is 68 days. This position looks good. No action required.

Another obvious mistake by IB is the theoretical and hypotehtical P&L chart as at close of next week 12-Sep. It is impossible for the Iron Condor to have profit higher than the credit received.

Trading Calendar

Monday Sep-8: KSE will be closed for trading

Tuesday Sep-9: KSE will be closed for trading

Wednesday Sep 10: KSE will be closed for trading

Weekly Market Reivew N225

N225 closed at 15,668.68 on Friday, 5-Sep-2014, gained 244.09 (1.58%) over the last 5 trading days. NKVI gained 1.72 (10.79%) ending the week at 17.66.

Last week, NKVI dropped with the drop of N225. This week NKVI gained with the rise of N225. This is unusual. NKVI should be inversely correlated to N225. However, this might not be really alarming as the movement in these two weeks were small (100-250 points).

Last week, I also mention that the range has expanded to 15,000-15,700 range. I could have underestimated the upper range. I think it is at least 15,800. Or 16,000 if N225 push higher next week. After all, N225 is still on uptrend on daily chart. However, N225 is at the upper end of the Bollinger Band. It could retrace lower before it move higher. Let's see.

Nothing much has change on the weekly/monthly chart, N225 is still on an uptrend.

October Position: Call Spread 16500/16750

October Position has a paper loss of about 3 points (JPY 3,000, before commission). N225 is about 830 points away from the Short Call. Delta is at 0.1045. DTE (Days To Expiration) is 33 days. This position does not looks too good (obviously since it is at a paper loss now). However, Delta is still healthy at 0.1045. It does not call for any adjustment, yet. Will start to plan for next action if Delta move closer to 0.2.

If N225 remains about the same for the next week, the time value decay (Theta) will bring the position to break even. Of course, this is just theoretical and hypothetical. In reality, N225 will move up or down, so is Delta, Gamma, Vega and IV.

November Position : Call Spread 17250/17500

November Position is currently at a paper gain of about 2 points (JPY 2,000, before commission). N225 is about 1580 points away from the Short Call. Delta is at 0.0727. DTE is 68 days. This position looks good. No action required. Probably will look for opportunity to add the Put Spread leg to form an Iron Condor.

Last week, NKVI dropped with the drop of N225. This week NKVI gained with the rise of N225. This is unusual. NKVI should be inversely correlated to N225. However, this might not be really alarming as the movement in these two weeks were small (100-250 points).

Last week, I also mention that the range has expanded to 15,000-15,700 range. I could have underestimated the upper range. I think it is at least 15,800. Or 16,000 if N225 push higher next week. After all, N225 is still on uptrend on daily chart. However, N225 is at the upper end of the Bollinger Band. It could retrace lower before it move higher. Let's see.

Nothing much has change on the weekly/monthly chart, N225 is still on an uptrend.

October Position: Call Spread 16500/16750

October Position has a paper loss of about 3 points (JPY 3,000, before commission). N225 is about 830 points away from the Short Call. Delta is at 0.1045. DTE (Days To Expiration) is 33 days. This position does not looks too good (obviously since it is at a paper loss now). However, Delta is still healthy at 0.1045. It does not call for any adjustment, yet. Will start to plan for next action if Delta move closer to 0.2.

If N225 remains about the same for the next week, the time value decay (Theta) will bring the position to break even. Of course, this is just theoretical and hypothetical. In reality, N225 will move up or down, so is Delta, Gamma, Vega and IV.

November Position : Call Spread 17250/17500

November Position is currently at a paper gain of about 2 points (JPY 2,000, before commission). N225 is about 1580 points away from the Short Call. Delta is at 0.0727. DTE is 68 days. This position looks good. No action required. Probably will look for opportunity to add the Put Spread leg to form an Iron Condor.

Subscribe to:

Posts (Atom)